Chargebacks are one of the most frustrating parts of running a business. No matter how careful they are about preventing fraud and keeping customers happy, every merchant is likely to get hit with chargebacks now and then. But if your chargeback rate exceeds 1% of your transactions, you can get flagged as high risk, which can make finding a payment processor and running your business harder. To avoid that, read about the five most common causes of chargebacks for merchants and what you can do to prevent them.

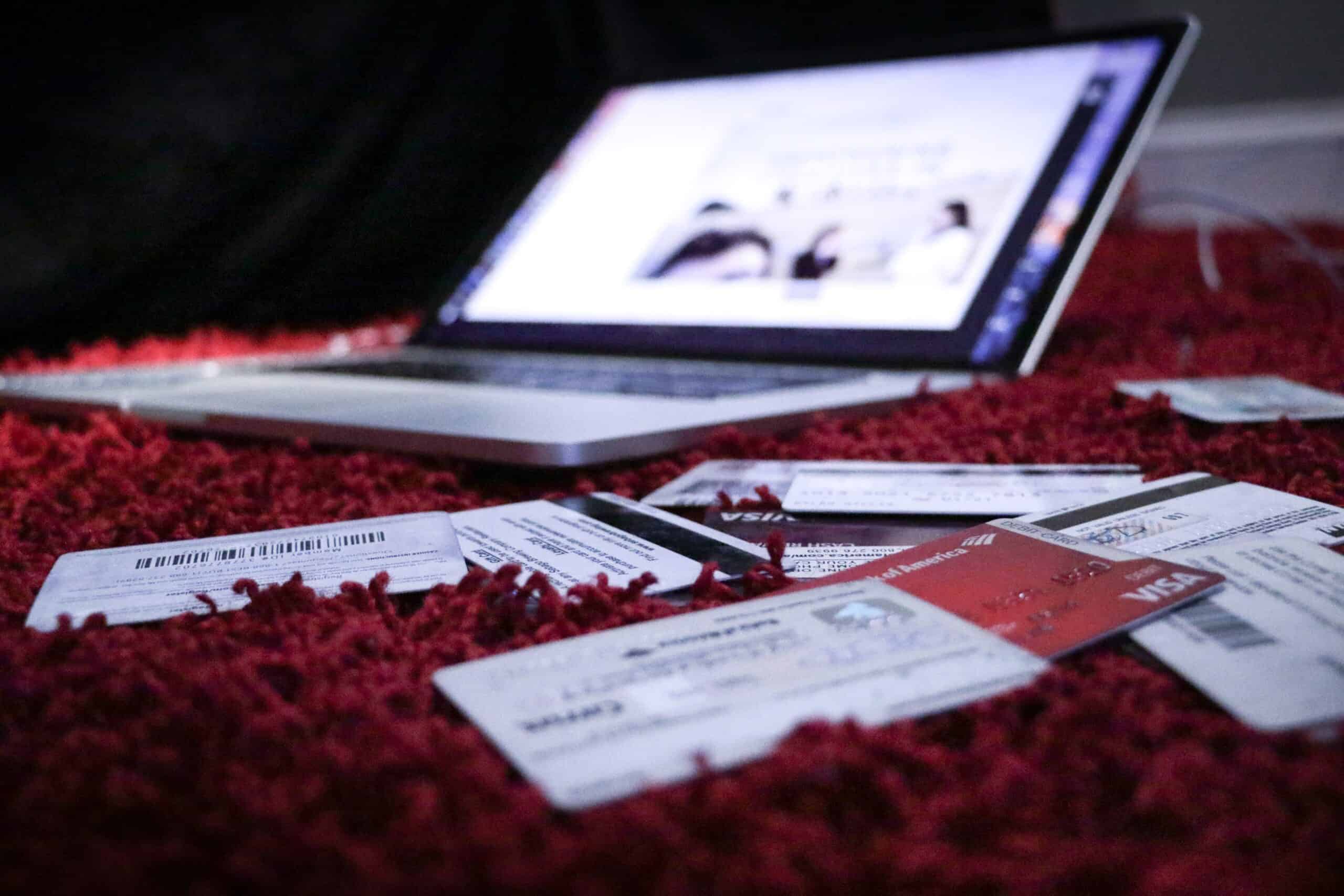

1. Fraud

How to Avoid Chargebacks for Merchants

For in-store transactions, train staff to check ID and only accept cards when the name matches that on the ID. For online transactions, make sure you use a payment processing like National Processing that comes with built-in fraud prevention tools.

Online security measures include flagging suspicious transactions such as those of unusual amounts or those with IP addresses that don’t match the physical address. You might also flag unusual changes to your daily order volume, order size, and other metrics that can help alert you that you might have received a fraudulent order.

2. Unrecognized Business Name

A surprisingly common yet easily avoided cause of chargebacks is unrecognizable business names. If your store front shows “Bob’s Plant Shop” but the legal business name appearing on the transaction is “Robert’s Landscape Supply,” customers might get confused and suspicious about the name. This can result in a dispute that can be difficult to clear up even though you’ve done nothing wrong.

How to Avoid Chargebacks for Merchants

To prevent this from happening in the first place, try to make sure your legal business name is as close to the name you use in your branding. If this isn’t possible, make sure your receipt or order confirmation mentions the business name that will appear on the transaction.

To improve your odds of winning a chargeback dispute, make sure to keep the following documentation:

-

- Copies of the transaction invoice

- Proof of delivery

-

- Proof that the cardholder and the recipient of the order are connected, such as a billing address matching the shipping address or matching names.

3. Shipping or Delivery Delays

Anxious shoppers can be extremely wary of shipping delays, especially from small businesses who don’t yet have an established reputation. If there’s any uncertainty around when to expect the delivery or a delay occurs at any point in the process, shoppers might jump to the conclusion that they have been scammed, and then dispute the charge.

How to Avoid Chargebacks for Merchants

The best way to avoid this source of chargebacks is with frequent and proactive communication. Some shipping and delivery best practices include:

-

- Clearly describe your shipping process on your website. Include which carrier you use and what delivery options you offer.

-

- Provide an estimated delivery window for each order as soon as it’s placed.

-

- Update customers on each stage of the process including when you finish preparing the product for shipping, when you take it to the shipping facility, when it’s in transit, and when it arrives at their address.

-

- Include a tracking number so customers can check the delivery status for themselves.

-

- Update customers about delays as soon as they occur.

The key is to make sure there is never a point in the delivery process where your customer is left in the dark about where their order is. The less mystery there is about the order, the less likely they are to leap to the conclusion that they are being scammed.

4. Canceled Recurring Subscription

Sometimes labeled as a “credit not processed” chargeback, this type happens for merchants who offer a subscription-based product or service. Sometimes, customers sign up for a subscription without realizing it’s a subscription. Sometimes, they simply forget to stop the subscription renewal. When they see the recurring charge show up on their statement, they might immediately dispute the transaction.

How to Avoid Chargebacks for Merchants

There are three things merchants can do to avoid recurring transaction disputes. The first is to provide a clear and transparent subscription terms. Is the subscription ongoing until the customer cancels it or is it for a set period like six months or one year? How often and on what day will the customer be billed? Set clear expectations so that there’s less chance of a misunderstanding when customers sign up.

The second is to provide an equally clear cancelation policy on your website. Explain how customers can cancel the subscription and when the cancelation will take effect. Will the cancelation result in a refund of the most recent payment or will it take effect on the next billing cycle? When customers submit their cancelation request, be sure to send a confirmation that the request was received and state exactly when the cancelation will take effect. If there will be a refund issued, provide an estimate of when it will be processed.

The third thing to do is keep thorough records for all of your subscription customers. Sometimes, you’ll get a chargeback from a customer who never even requested a cancelation. The burden falls on merchants to prove that they never received a cancelation request. The documentation you’ll need to prove your case includes:

-

- The subscription cancelation policy that your customer agreed to

-

- A screenshot or other record showing that the customer was provided with this cancelation policy at the time of signing up.

-

- Proof that you sent a notification to the customer ahead of renewal or continuation of subscription. This could be a monthly billing statement emailed to the customer reminding them of the upcoming payment.

5. Refund Issues

Another reason a “credit not processed” chargeback happens is because a customer requests a refund but does not receive it. Sometimes this might be the result of merchant error, but it’s often the result of miscommunication.

If a customer doesn’t know how to request a refund, they might just go straight to disputing the charge instead. If a customer does request a refund from the merchant, they might not know how the process works or when to expect the credit to show up on their statement.

How to Avoid Chargebacks for Merchants

As with shipping or delivery issues, the best way to avoid this type of chargeback is with frequent and proactive communication. That includes the following:

-

- Provide a clear description of your refund and return processes on your website, including how long after delivery an order is eligible for return or refund and what steps customers should take to make the request.

-

- Respond to refund requests promptly. If the order is passed your return eligibility window, say so. If not, explain any next steps, including how to pack and ship for return.

-

- Be clear about the timeframe. If you don’t process refunds until you receive the returned item, say so. Be sure to also provide an estimate of how long it might take from the moment you authorize the refund to the moment it appears on their statement.

-

- Update customers throughout the refund process.

In addition to communication, keep all of this as documentation in case you need to fight an illegitimate chargeback. If a customer requests a refund but their order is ineligible or they fail to return the item in appropriate condition, you will need to be able to prove that the customer was aware of your policy and proof of the reason the customer was ineligible for a refund.