Why use a credit card processing calculator? There are several good reasons we are going to cover in this post, but the main reason is simple.

Payment processing fees are one of the few expenses business owners don’t have a concrete estimate for. Even utility bills, which fluctuate, are easier to budget and plan for.

That’s why National Processing has worked tirelessly to make our fee calculator the most precise one available. Business owners need solid estimates so they don’t get blindsided by fees that are higher once they start a new business or change processing providers.

You can use our online fee calculator for free.

Let’s look closer at why you should use a calculator before choosing a payment processor.

Top 3 Benefits Of Credit Card Processing Calculators

It doesn’t matter what type of business you are in — saving on expenses improves your business. This leaves you with extra funds for business growth. Savings are the first benefit.

- An online fee calculator can reveal the processing company offering the best value

- A modern calculator is nuanced with details (like industry type)

- Compare what you pay now to what you would pay if you switch providers

Using a calculator for a payment processing cost analysis is no different than shopping around for the best deal from any other vendor.

For example, an e-commerce business owner would shop around for the best value on shipping supplies before choosing a vendor. Those supply costs affect owner profits. Not just weekly, but for years should the business do well and begin to thrive. The same principle applies to payment fees.

And here’s why online fee calculators are even necessary…

Transparency Via Credit Card Processing Calculators

If you have been in business any time at all, you likely know there are sketchy tactics in the credit card processing world. Shameful, but true.

New business owners may not be aware of this issue, though.

These new owners can avoid signing with a less-than-honest provider by using a calculator before signing a contract.

As for experienced business operators, they can benefit from credit card processing calculators when they are considering changing providers.

While no fee calculator is perfect, at National Processing, we have made every effort to ensure ours paints the clearest picture of fees you can expect to pay.

Now, some online fee estimators may still hide costs.

What To Watch For With Online Fee Calculators

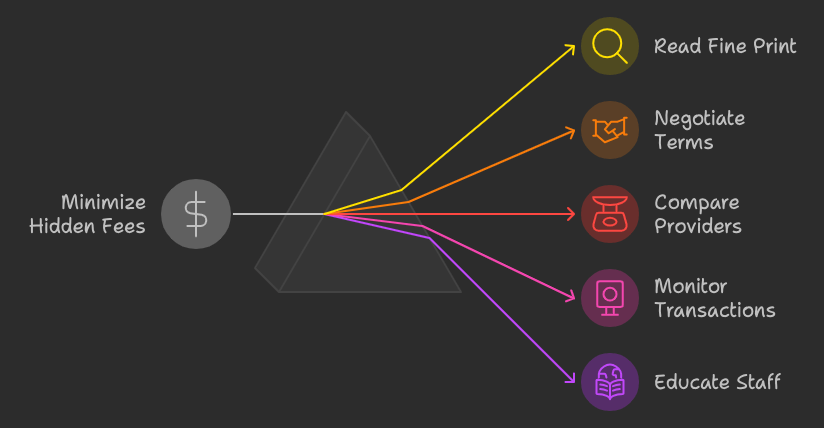

With payment processing, you have to do your homework before signing a contract.

Even with a calculator, business owners must protect themselves.

Here are five things to be wary of with any payment processing cost analysis tool.

- Omitting info about statement fees, PCI compliance fees, or early contract termination fees

- Exclusion of certain fees in “effective rate” calculations

- Some fee calculators only highlight the lowest-priced tier based on sales volume

- Processor’s markup versus card network costs may be purposely murky

- Payment equipment costs or leasing fees may be left out

To be clear, just because a credit card processing calculator doesn’t show every possible expense, it doesn’t mean the provider is hiding something.

It may simply be left out due to space limitations or the inability of the calculator to estimate a fee without further information about the business.

Let’s show you exactly what our official National Processing Fee Calculator details. Then, we’ll give you more things to be aware of with calculators.

National Processing’s Payment Processing Cost Analysis

Here are the main details that get plugged into our fee calculator.

- Choice of six industries

- Average monthly processing volume

- Average monthly number of transactions

- Average monthly processing fees you currently pay

Those are input by the business owner.

Then, the calculator produces the following output to give you a clearer estimate of your processing fees with our company.

- Plan recommendation (choice of four plans)

- Percentage and flat fee on each transaction

- Estimated monthly fees total

- Estimated savings compared to your current provider’s fees

We also highlight benefits that are incalculable. Benefits like our online gateways, 24/7 U.S.-based customer service, and no contracts!

That’s no typo, either. National Processing is one of the few acclaimed processors that doesn’t require a contract.

Now, let’s dig into those other things to note about any online fee calculator.

Credit Card Processing Calculator Blindspots

Again, a fee calculator is designed to give clearer fee estimates. They cannot predict all the variables that come with running a business, though.

What are those variables and nuances?

For starters, credit card processing companies can’t control interchange rate increases by card networks (i.e., Mastercard and Visa). Similarly, there are many different types of credit and debit cards today. These varying cards affect processing rates, and their use is impossible to predict.

Then you have sales volume fluctuations. These are caused by seasonality, market swings, supply chain disruptions, etc. A decrease in sales volume can put business owners in a different processing plan level, possibly increasing their rates temporarily. The flip side is an increase in sales perhaps putting you into a lower-fee plan, if your contract allows for that advantage.

Another key variable is the dreaded chargeback

It’s tough for a credit card processing calculator to tally up fees brought on by chargebacks.

Even if you have an average number to input, your chargebacks could go up in a given month or year.

The bad thing about this variable isn’t just the unpredictable nature of the fees. Business owners get loaded down with the extra hassles of fighting chargebacks.

Every minute wasted on this activity takes away their time from running the business. Not only that, but even winning a chargeback dispute doesn’t erase the harm of a chargeback being filed in the first place.

What are other online fee calculator blindspots?

- Processors may introduce new fees or change their fee structures

- Customer behavior changes from card-present to card-not-present (i.e., during pandemic lockdowns)

- Custom rates for unique or huge businesses may not fit into a calculator’s format

- International transactions would alter estimates should a business add global sales

- A low-risk industry could become labeled high-risk for various reasons, producing higher fees

- Spikes in fraud can spike fees above initial calculations

Now that you know the limitations of fee calculators, here’s how to avoid those blindspots when estimating your processing fees. Then, we will conclude with three key questions about merchant cost savings.

How To Get Accurate Credit Card Processing Calculator Estimates

Before using a calculator, gather all your sales data from the past twelve months (please don’t guess).

Next, research current chargeback rates for your industry. This helps you understand costs that may not be in the fee estimate.

Then, consider your growth. Has your business grown by five, ten, maybe twenty percent in recent years? Can you continue to scale and hit a level of sales that qualifies you for a volume discount on fees?

Lastly, we suggest you use multiple online fee calculators. This gives you a fuller picture of potential processing fees your business will pay. At National Processing, we believe in being transparent, so we have no issue with you using our calculator along with others to ensure you get the best processing rates.

We believe you will see we do offer the lowest rates, bar none. Our $500 Guarantee of the lowest rates says it all.

Start saving today with National Processing.

FAQ Merchant Cost Savings

How can I lower my credit card processing fees without switching providers?

Easy wins include negotiating your rates, using better fraud prevention tools, and batching transactions daily (delayed batching often comes with fee hikes).

What’s the difference between interchange-plus and flat-rate pricing?

Interchange-plus clearly shows business owners the processor markup fees versus the card network fees. Flat-rate is a simple fee plan that charges the same fee for all transactions regardless of card type, processing method, etc. Owners must consider sales volume and time they can dedicate to fee management when deciding between interchange-plus and flat-rate pricing.

Would median numbers provide more accuracy than averages in fee calculators?

Median values offer a more precise representation of a business’s typical transactions compared to averages. Medians minimize the impact of extreme outliers and are especially beneficial for businesses with varied product lines or occasional high-value sales. See visual below.