In 2022, about half of all ecommerce payments worldwide were made with digital wallets, including mobile apps and online software like Apple Pay and PayPal where users can store different payment methods to use to make online or in-store purchases. For consumers, they are safer and more convenient than carrying a physical wallet. While they can also be safe and convenient for merchants, there are some important factors to consider if you want to accept digital wallet payments, especially as an ecommerce merchant.

What Is a Digital Wallet?

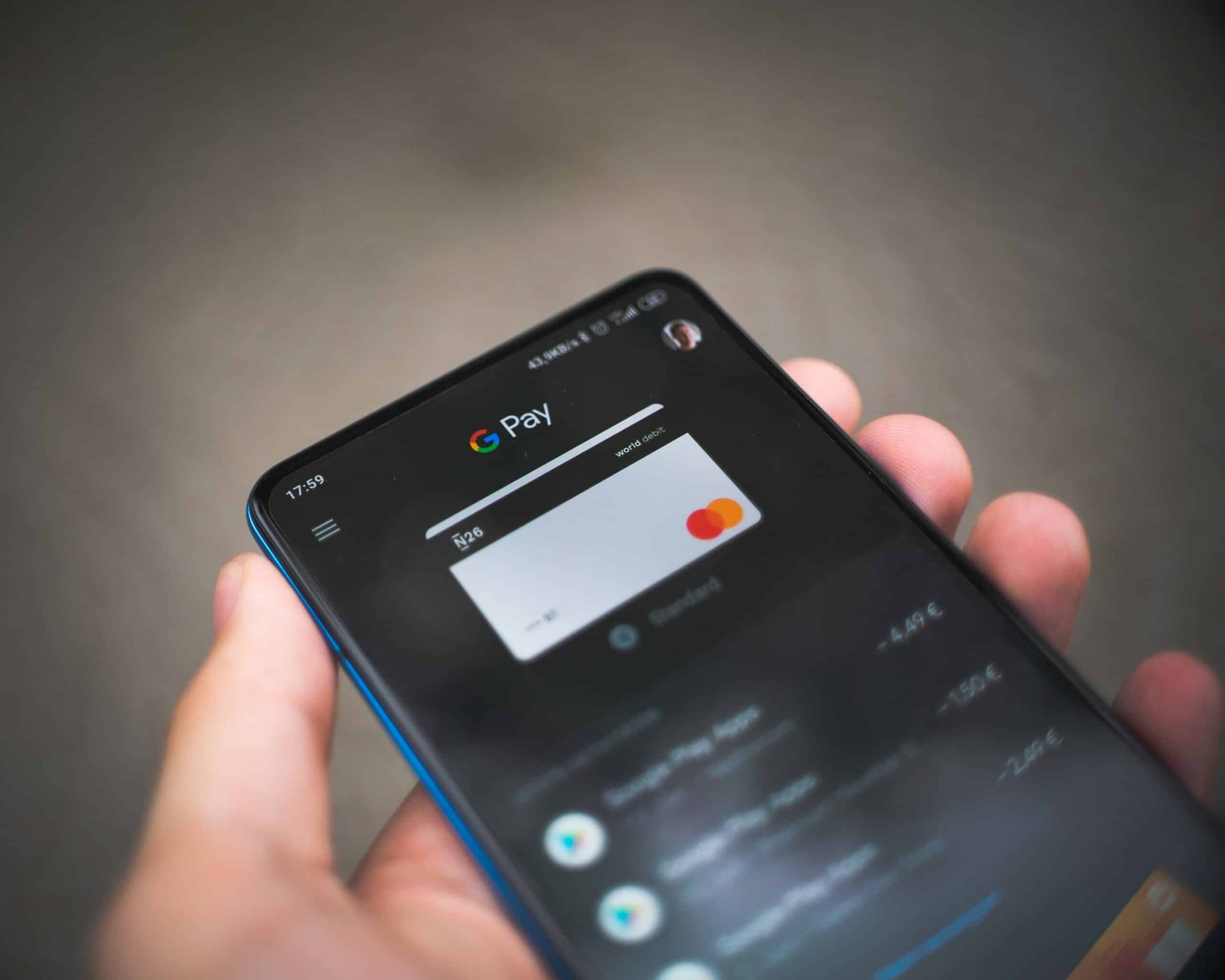

A digital wallet is what it sounds like: a digital version of a physical wallet. Those who have one can store different payment methods in it by adding their credit or debit card information or loading it with funds. When they want to make a purchase, instead of pulling out a card and typing the information in the online checkout form, they just click on their digital wallet and, if relevant, choose their preferred payment method.What happens next depends on the type of digital wallet being used. If it’s a pass-through wallet like Apple Pay, the transaction is processed similar to a card-not-present transaction, in the sense that the wallet sends a tokenized version of the payment information to your payment gateway which than passes it along to your payment processor to be processed like a card-not-present transaction. For merchants, the interchange fees are the same as a card-not-present transaction.If it’s a stored value or staged digital wallet, like PayPal or Google Pay, on the other hand, the funds are first collected by the wallet and then passed along to the merchant’s own wallet on the same platform. In this version, the process is more similar to a peer-to-peer transaction. Some digital wallets charge transaction fees to merchants for accepting payments this way, but some don’t.

What Do Merchants Need to Accept Digital Wallets for eCommerce?

The good news is that you don’t need any additional hardware or software to accept digital wallet payments online. But you do need a payment gateway, payment processing service, and an ecommerce platform that are compatible with the digital wallets you want to accept. As the technology becomes more common, it’s becoming easier for merchants to find payment processors and other services that allow for popular digital wallets like Google Pay or Apple Pay. However, it’s still important to compare the fees different providers charge for digital wallets. To make sure you’re getting the best deal on transaction fees, it’s often better to choose a payment processor that uses interchange-plus pricing to set their fees. Instead of a flat rate across all transactions, payment processors like National Processing charge merchants the actual interchange rate, which can range from about 0.3% to 2.5% plus a fixed fee for its service.

The Benefits of Accepting Digital Wallet Payments for eCommerce

As a merchant, the more payment methods you can offer, the better. Customers appreciate having the option to pay with the method of their choice. And considering that over half of ecommerce transactions are already being done through digital wallets, merchants can’t really afford to ignore this trend anymore. But there’s more perks to accepting digital wallet payments than just keeping up with the trends. The software these new payment options use incorporate advanced security features like encryption, tokenization, and other fraud prevention tools to keep a customer’s data safe. That extra layer of security can, in turn, help reduce the risk of chargebacks on these payments. Chargebacks are not only costly for merchants, but can also lead your business to be categorized as high risk if you have too many of them. The convenience and speed of payment that digital wallets offer can also mean boosted sales for merchants. On average, over 70% of online shopping carts are abandoned before the customer actually makes a purchase. The majority of those abandonments happen because online shoppers typically use carts while browsing products, long before they’re ready to buy. But of the cart abandonments that aren’t the result of users who were just browsing, some of the most common reasons users cited for skipping out before making the purchase including long, complicated checkout processes, not enough payment methods, or not trusting the site with their credit card information. By offering customers the option to pay with their digital wallet, you can eliminate all three of those reasons for cart abandonment.

The Risks of Accepting Digital Wallet Payments for eCommerce

There aren’t too many downsides for ecommerce merchants who want to let customers pay with their digital wallets. As long as your payment processor and ecommerce problem offer the option, it’s fairly easy to set up the integrations you need to enable digital wallet payments on your website. With that said, one of the main risks a merchant could face is using a digital wallet themselves to store the funds they receive from their sales. If you accept payments via Cash App, Venmo, or Paypal, for example, letting your funds sit in those apps can be risky because they are not insured by the Federal Deposit Insurance Corporation (FDIC). So, if the business were to shut down, your money could be lost and you would have no recourse or protection to get it back.Because they aren’t FDIC insured, it’s better to transfer any funds you receive immediately into an actual bank account. Another drawback to offering digital wallet payments is that the market is so fragmented right now. There are dozens of wallets available and it can be hard to figure out exactly which ones your customers are using. For example, you might take the time to set up Google Pay and Apple Pay only to find out your customers are complaining that you don’t offer Android Pay or WeChat Pay. Before you switch to a new ecommerce platform or payment service provider, try to do some market research and find out what kind of digital wallets your target customers are most likely using. That way, when you start shopping around for new services, you know which specific payment methods you need to be on the lookout for.

Frequently Asked Questions About Digital Wallets in eCommerce

Here are some of the most frequently asked questions merchants have about digital wallets.

What is a digital wallet?

A digital wallet is a type of software that can store multiple payment methods in one convenient digital location. Instead of inputting your payment information every time you want to buy something, you can just tap on your digital wallet, tap the payment method you want to use, and the wallet does the rest.

Are digital wallets safer than credit cards?

Most digital wallets offer an added layer of security over a traditional credit card because it tokenizes the credit card information, an enhanced security method where sensitive information is turned into an indecipherable jumble of symbols. Even if a data breach were to occur, all a hacker would find is that indecipherable jumble of symbols, not the actual credit card information. This can make them safer than carrying around a physical credit card that can get stolen.

Can digital wallets be stolen?

While the enhanced security features in digital wallets can keep your data more secure, customers still need to be careful about who has access to that wallet. If your login details or your smartphone are stolen, the thief would be able to access your wallet and use the payment methods inside it. Another risk that can come with digital wallets is the lack of FDIC insurance on any funds you hold in the wallet. Money stored in your Cash App, Venmo, or Paypal balance is generally not protected by the FDIC, which means that you could lose that money if the wallet provider goes out of business.