As a business owner, you may not know exactly how a payment gateway works. It may not even be apparent why you need a guide on a payment gateway’s inner workings.

After all, a mechanic doesn’t need to explain how a car transmission works to the customer. All the customer wants is a brief explanation of the problem and how much it will cost to fix their vehicle!

However, once you have a basic overview of payment gateways, you will be in a better position to utilize your gateway efficiently and save on fees at the same time.

So let’s get started. We promise not to bore you with needless technical details.

Payment Gateways Offer Secure Transactions

Here’s the simplest definition we can provide. A payment gateway is a technology for businesses to accept digital payments from customers.

Payment gateways are used for payments inside brick-and-mortar stores in the real world and for online purchases.

Think of this gateway as the invisible path that funds travel on — from a customer’s funds into the business’s bank account.

The customer funds may start in the form of a credit card, debit card, or money inside their digital wallet. The funds travel from there and end up in the bank account of the business.

Once the funds are in possession of the business, it can use them for paying expenses, payroll, supply ordering, etc.

Think of this process as a circular cash flow except it’s digital money instead of paper money.

Simple enough, right?

Now we can look at the steps involved in this flow of digital money. This knowledge will set the table for learning how to leverage your payment platform in numerous ways.

How Payment Gateways Work (Step-By-Step)

- Customer initiates payment

- Payment gateway instantly encrypts payment data

- Authorization request sent to bank

- Customer’s bank sends details to card network (i.e., Visa or Mastercard)

- Customer’s bank approves or denies transaction, relaying decision back to card network

- Decision is relayed to merchant’s bank

- Then the decision heads to merchant website or POS

- Approved transactions mean merchant fulfills order

- Denied transactions stop the order from completing

- Funds arrive in business’s bank after owner batches the day’s transactions

Most of the activities are behind the scenes during this speedy process.

Here’s how payment gateways work to provide security during these microseconds.

Sensitive card data is replaced with unique tokens. This is called tokenization.

Then, you have AVS, address verification service, to verify the billing address matches the customer record. Some gateways also utilize 3D secure as an extra layer of fraud prevention. Others have started using algorithms to identify suspicious activity.

These security actions happen at blazing speeds in less time than it takes a store owner to thank a customer for their business.

With an overview of how payment gateways work, let’s look at how you can leverage that info.

Payment Processing Knowledge Is Power

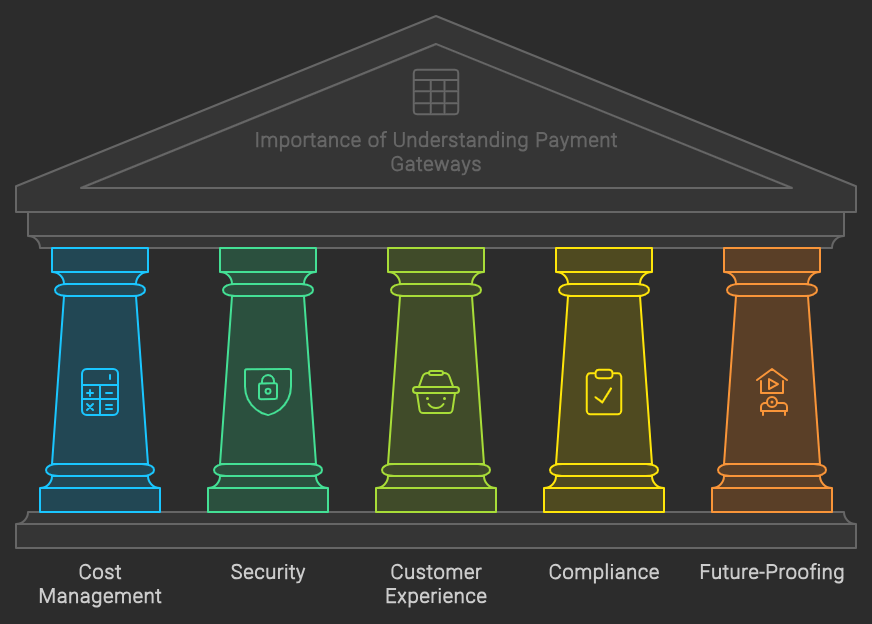

Business owners who understand the process of payment gateways can better compare different providers’ gateways (costs, contracts, features, security requirements, etc.).

It would be similar to a car owner knowing the basics about transmission repair costs. That knowledge helps her compare repair estimates from multiple repair shops, to get the best value for her money.

Another advantage of payment gateway insights is the ability to fight off fraud. Not only will business owners better understand fraudsters’ tactics, but owners can dial in their gateway’s security features.

What about customer experience and cash flow?

Better customer experience leads to happy customers with a higher lifetime value to the business.

Smooth checkouts, online or offline, delight customers. And efficient checkouts are a given when a business owner understands what causes delays. She can then train staff on ways to ensure seamless transactions.

Believe it or not, cash flow can be affected by how well you know your payment gateway processes.

For example, understanding settlement times can keep you from making cash management mistakes like trying to settle after 4 PM on Friday. This could delay funds arriving in your account until the following Monday or Tuesday, depending on your payment processing provider.

HOW PAYMENT GATEWAYS WORK WITH COMPLIANCE AND INTEGRATION

There are numerous payment and data compliance issues business owners have to stay on top of already.

That list continues to grow beyond PCI DSS, GDPR, and basic local laws.

California and Colorado, for instance, have focused heavily on privacy regulations recently.

Knowledge about your payment gateway helps keep your business in compliance, now and into a more complicated future of privacy.

And privacy is difficult to balance as consumer studies show they value privacy but also want personalized offers from businesses. These offers are often shaped through access to consumer shopping habits.

As for integration, imagine having two or three key pieces of software for your business and not being able to connect them to your payment processing system. Or, if you can integrate, what would you do about glitches that slow down or stop transactions?

That’s when knowing how payment gateways work comes in handy. Further, knowing your payment processing company understands and cares about your business is just as important.

Disputes and Negotiation

Business owners who have a grasp on their payment gateway features can rest easy because they won’t be hit with as many disputes or chargebacks. These informed owners will be able to set their gateways up to be as secure as possible for their specific industry.

Going back to the car analogy, understanding the basics of how a transmission works, means the car owner won’t expect a $300 invoice. They will understand it’s going to cost thousands of dollars, not hundreds.

When a business owner knows how payment gateways work and all the benefits, they better understand the costs associated with this payment technology. This helps them budget properly and maybe be able to negotiate lower rates if they don’t need every gateway feature.

We get it. Many business owners want to save money on all their expenses.

That’s smart business and it’s why some try to find ways to avoid paying for a payment gateway.

Is A Payment Gateway Mandatory For Secure Transactions?

If you have a business big enough to need a payment processor and not just a basic payment app like Venmo, then yes, you need a payment gateway.

Sure, there are open-source platforms out there where a tech-savvy person could theoretically set up their own payment gateway. A skilled coder could even build a patchwork system from scratch, perhaps.

However, that possibility is only available to a select few people with the technical skills to pull it off.

For most business owners, a payment gateway is an inherent business expense. The good news? There are endless ways your online payment system and gateway help scale your business.

When your business grows, the additional revenue overshadows the expense of a payment gateway.

Plus, a top-notch payment processing provider ensures your business is always trusted by customers. How? A top provider will have the most secure payment gateway, hardware, and cloud services. This helps prevent fraud and data breaches.

A strong reputation for trust is one of the most valuable assets a business can have.

How Payment Gateways Work, Summed Up

Now that you understand how a payment gateway works, you can leverage that to improve all aspects of your sales transactions.

Not only that, you’re now on even ground with payment processing providers to negotiate services, features, and pricing.

Payment gateways can seem like a mysterious part of accepting payments. Yet, the most critical parts are fairly simple. The main point of a reliable payment platform is to safely move customers’ funds to your business account without delays, hidden fees, or fraud hurting your business.

To be sure we have you covered, we’ve listed a few extended bits of intel on payment gateways and secure transactions below.

But if you’re ready for a world-class payment gateway and the lowest transaction fees…

FAQ How Payment Gateways Work

What is the typical fee structure for a payment gateway?

Payment gateways usually include a combination of per-transaction fees (e.g., 2.9% + $0.30 per transaction). Monthly fees can be part of a contract as well, depending on the provider you choose. Fees can vary based on your sales volume, risk level of your industry, in-person vs. remote payments, etc.

How do payment gateways integrate with e-commerce platforms?

Many payment gateways offer plugins. Common examples are the countless WordPress plugins small business websites use to connect with payment platforms. APIs are another way to integrate gateways with e-commerce platforms but require deeper technical skills (some providers offer custom API integration). The most popular platforms, like Shopify and WooCommerce, are often built into online payment systems.

What is a hosted payment gateway?

This payment gateway redirects customers to the gateway’s separate payment page to complete the transaction rather than processing the payment on the merchant’s website. This heightens security. However, having the webpage change as shoppers are checking out can cause them to become suspicious of the process. It would be like checking out with one cashier at Kroger, then being ushered to the pharmacy to complete the checkout—it would feel “odd.” We suggest going through your checkout process to feel your customer’s experience with a hosted payment gateway.

How do payment gateways handle recurring payments for subscription businesses?

Many offer features like automatic billing, retry logic for failed payments, and tools for updating payment info. Updating customer info is crucial to avoiding uncompleted payments and losing a customer as a result. Automatic billing can eliminate invoicing errors, reduce time spent on invoicing by up to 80%, and greatly improve cash flow.