Why do many small to medium business owners doubt they can lower credit card processing fees?

It’s because too many payment processing providers have used unethical pricing practices like hidden fees for decades. This has disheartened many SMB owners, leaving them to accept credit card fees that are, frankly, out of control in many industries.

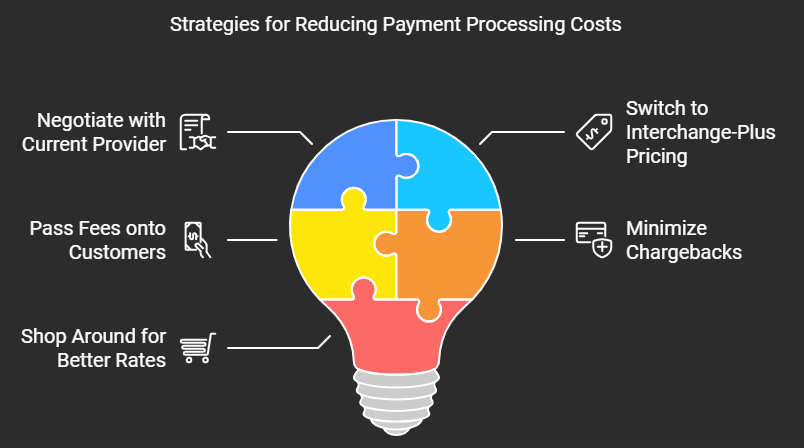

At National Processing, we believe in offering hope and viable solutions to business owners across this great country. That’s why we are laying out five proven strategies to reduce payment processing costs.

As a bonus, we have concrete examples of the savings businesses can realize using these tactics.

Merchant Fee Savings Strategies (details will follow)

- Negotiate with current provider

- Switch to interchange-plus pricing

- Pass fees onto customers if possible (offer cash discount)

- Minimize chargebacks

- Shop around for better rates

#1 Way To Lower Credit Card Processing Fees

Negotiation: We feel the easiest strategy for merchant fee savings in most businesses is negotiating with your current payment processing company.

This strategy will work best if your business is established and you have a good relationship with your provider. If your sales have grown recently, you have even more negotiating power.

Another advantage for you? Many other payment processing companies want your business. They desperately want it, so don’t let that advantage slip away. If your current provider can’t give you a better rate or move you to a more cost-friendly plan, let them know you are shopping around.

That could change their tune since your current provider doesn’t want to lose your business. Let the competitiveness of the payment industry be your leverage for lower credit card processing fees.

Example Merchant Fee Savings

Below are calculations from various hypothetical business scenarios. They show the concrete potential for savings through negotiation.

Small Coffee Shop

The owner has grown to five locations. The current rates have her paying around 3.2% in processing fees. The owner approaches her processor with competitive quotes from other providers and highlighted her booming sales volume. As a result, they negotiated her rate down to 2.8%. On annual sales of $525,000 annually, that would save the owner roughly $2,100 each year.

Online Clothing Retailer

An e-commerce clothing store processing about $125,000 in annual sales was initially paying 2.9% + $0.30 per transaction. The owner expanded to a new third-party marketplace to increase the customer base. This produced faster sales growth to $180,000 that he could show (with detailed POS financial reports) to his current processor. This proof enabled him to negotiate his rate down to 2.6% + $0.25 per transaction, resulting in yearly savings of about $540 (without even figuring the five cents saved per transaction!).

Dental Practice

A dental office processing $1.7 million annually in credit card payments was paying 3.1% in fees, on average. They negotiated with their processor by highlighting their long-term relationship after being in business six successful years. The processor reduced their rate to 2.7%, lowering their annual credit processing fees from $52,700 to $45,900, just because the practice asked.

See? Any business can use negotiation to save on transaction fees.

Here are the keys to negotiating:

- Show evidence of consistent and rising transaction volumes

- Lower your transaction risks (fight fraud, fend off chargebacks)

- Show documented potential for future growth

- Remind your current processor how you’ve been loyal to them

- Get to know competitors in the processing space in case you do need to change providers

If you’ve sent referrals to your current merchant services provider, that can give you more leverage.

Next up is the…

#2 Way to Lower Credit Card Processing Fees

We almost put this strategy behind number three below. However, this option — interchange-plus pricing — is more widely available.

Interchange-plus pricing is super-transparent and is the most cost-effective payment solution for the majority of businesses.

If you want to see how interchange-plus can lower your credit card processing fees, just do a search for a fee calculator on the ole Google machine.

It’s free and easy to use and shows the advantages of interchange-plus pricing.

Example Merchant Fee Savings

Electronics Retailer: Before interchange-plus, the business might pay via a tiered structure.

- Qualified rate: 1.79% + $0.10

- Mid-qualified rate: 2.19% + $0.10

- Non-qualified rate: 2.99% + $0.10

- Average effective rate: 2.45%

After going to interchange-plus pricing (at + 0.30% + $0.10) the average effective rate could drop to 2.10%. If their annual credit card sales were $5 million, the estimated annual savings would reach $17,500.

Online Subscription Service

Being on a flat-rate pricing, this business might pay 2.9% + $0.30 on all transactions. Their average effective rate is a simple 2.9%.

After moving to interchange-plus pricing (at + 0.15% + $0.10) their average effective rate is reduced to roughly 2.35%. With an example sales revenue of $2 million, this subscription business would save an estimated $11,000 each year and could reinvest it in their company.

Number three might be your best bet, but it depends.

#3 Way to Lower Credit Card Processing Fees

There are two reasons business owners don’t take advantage of this fee reduction tactic — pass processing fees onto customers.

One reason is local laws may limit or prohibit it in their area.

Two, they feel their customers will not like this policy.

The first issue is difficult to overcome sometimes. But please don’t let the latter reason stop you from saving on credit card fees. Thousands of businesses use this strategy and it adds up to enormous savings for owners.

Further, customers are now used to transaction fees being passed onto them in this day and age. The practice has become the norm in many parts of the U.S. And when you offer a cash discount, customers are getting the chance to avoid the debit / credit card fees just like you. So, it’s a win-win.

In fact, one florist in the Southeast reported that she had zero complaints when she began passing payment fees onto customers. They understood fees are part of shopping, plus most had shopped with this florist for years.

Example Merchant Fee Savings

Garden Supply Store

It offers a discount for cash payments. The posted price for a lawn mower using a credit card is $3,199. The cash discount is 3%, lowering the cash price to $3,103. This saves the customer nearly $100.

Convenience Store

For small transactions (soda, water, candy, etc.), a gas station might implement a minimum purchase amount for credit card use or apply a surcharge for transactions below a specific amount. For example, shoppers would have to use cash for totals under $5, which ensures owner profits aren’t eroded by fees on low-margin items.

#4 Way to Lower Credit Card Processing Fees

We’re close to the end of our strategies. Just know that number four shouldn’t be underestimated.

Minimizing chargebacks will have a major positive impact on reducing your processing fees.

Prevention is the key. Managing chargebacks after they happen is part of any business. Yet, the more chargebacks you prevent from initiating, the easier your life will be.

Build trust with your customers online and offline. Show them you will always put them first. Treat them as you want to be treated. Highlight your certifications, awards, testimonials, and charitable giving in the community.

Fewer disputes mean your cash flow isn’t disrupted and your time isn’t wasted fighting chargebacks.

Do note that some “customers” are not the ones you want. Meaning, some are criminals using the chargeback system to get free goods and services. This so-called friendly fraud is on the rise, so beware.

Example Merchant Fee Savings

Restaurant

Management could use food delivery confirmation signatures and clearly communicate delivery times to reduce chargebacks (and unhappy customers). If they cut their chargeback rate by 50% (down from the restaurant industry average of 0.12% to 0.06%), they would save hundreds of dollars per month (more if their chargeback fees are extreme).

Home Services

Clarifying all communications on pricing and service details will reduce the chance for disputes. This type of business could have clients sign off on completed work and use follow-up calls / emails to ensure they are satisfied with the work. These two steps alone could cut the chargebacks in half. That could save business owners thousands on high-ticket services like HVAC replacement.

Time for the last but not least among our five strategies.

#5 Way to Lower Credit Card Processing Fees

Shop around for a better rate. With National Processing, there’s no risk for testing our rates.

Start saving today→ sign up here.

Unlike other processors, you can avoid signing a long-term contract with National Processing.

Just remember, if you shop around with other companies—watch for hidden fees.

Another key to notice is how helpful the payment processing rep is. Are they rushing you to sign a contract without clear details on set-up, integrations, troubleshooting, and hardware costs?

That’s a sign that they are looking for your name on the dotted line instead of wanting to serve you the right way.

If that’s the case, do yourself a favor and keep shopping around until you find a customer-first provider.

Let’s Chat – We take pride in our customer service team and sales reps as much as we do our cost-saving fee structure.

Example Merchant Fee Savings

Fast Food Eatery: With a busy drive-thru, this example business sees 550 daily transactions (200,750 transactions a year). The owner shops around and a flexible payment provider offers to lower their per transaction fee by two cents. That seemingly small reduction adds up to over $4,000 in savings for the business each year.

Conclusion

Even if you can only try one of the five strategies we talked about, please do so asap.

The sooner you begin, the sooner your savings start adding up!

There’s no downside to testing new cost-effective payment solutions either. Investigating ways to save your company money is what all successful entrepreneurs have done throughout history.

FAQ

Name two credit card processing tips to save time and money.

1)Consider ACH payments for recurring payments. 2)Upgrade payment hardware to avoid delays resulting in lost sales and unhappy customers who will shop elsewhere.

What are interchange optimization techniques, and how can they lower processing costs?

This tactic involves systematically structuring transactions to qualify for the lowest possible interchange rates (i.e., properly categorizing transactions such as business vs. consumer cards).

Do high-risk businesses always pay more in credit card processing fees?

Yes, but by using secure best practices and making your business more trustworthy consistently, you can reduce the risk rating and get reduced rates as a result.