It’s hard to imagine, but paper money is a very recent trend in the long history of currency. It was all about coins, bullion, and the value of precious metals before then, and nations only dropped the gold standard in the 20th century. Even the idea of checks and bank accounts had to be invented back in the Middle Ages.

Currency and payment methods depend a lot on technology and innovation, both of which are advancing much faster today than they ever have before. Credit cards showed up around 100 years ago, then cards with magnetic strips a computer can read, and now we’re using cards with embedded microchips to get the most security possible. And that’s just credit: other modern payment methods include debit cards, online transactions, and smartphone “wallets” that let you store and spend money electronically.

The Death of Checks

For years now, the number of businesses that accept checks has been on the decline. Checks still make sense for some industries, such as rental properties and car dealerships, but retail businesses cut out a lot of their daily headache by refusing to take checks since it speeds up the register lines and it means they only have to worry about cash deposits and dealing with a single card processing company that will quickly complete a transaction.

However, payment methods haven’t stopped evolving. Cash payments are starting to fall out of favor thanks to the greater security and cheap processing fees of electronic methods, and according to one survey, 25 percent of organizations stopped accepting cash entirely.

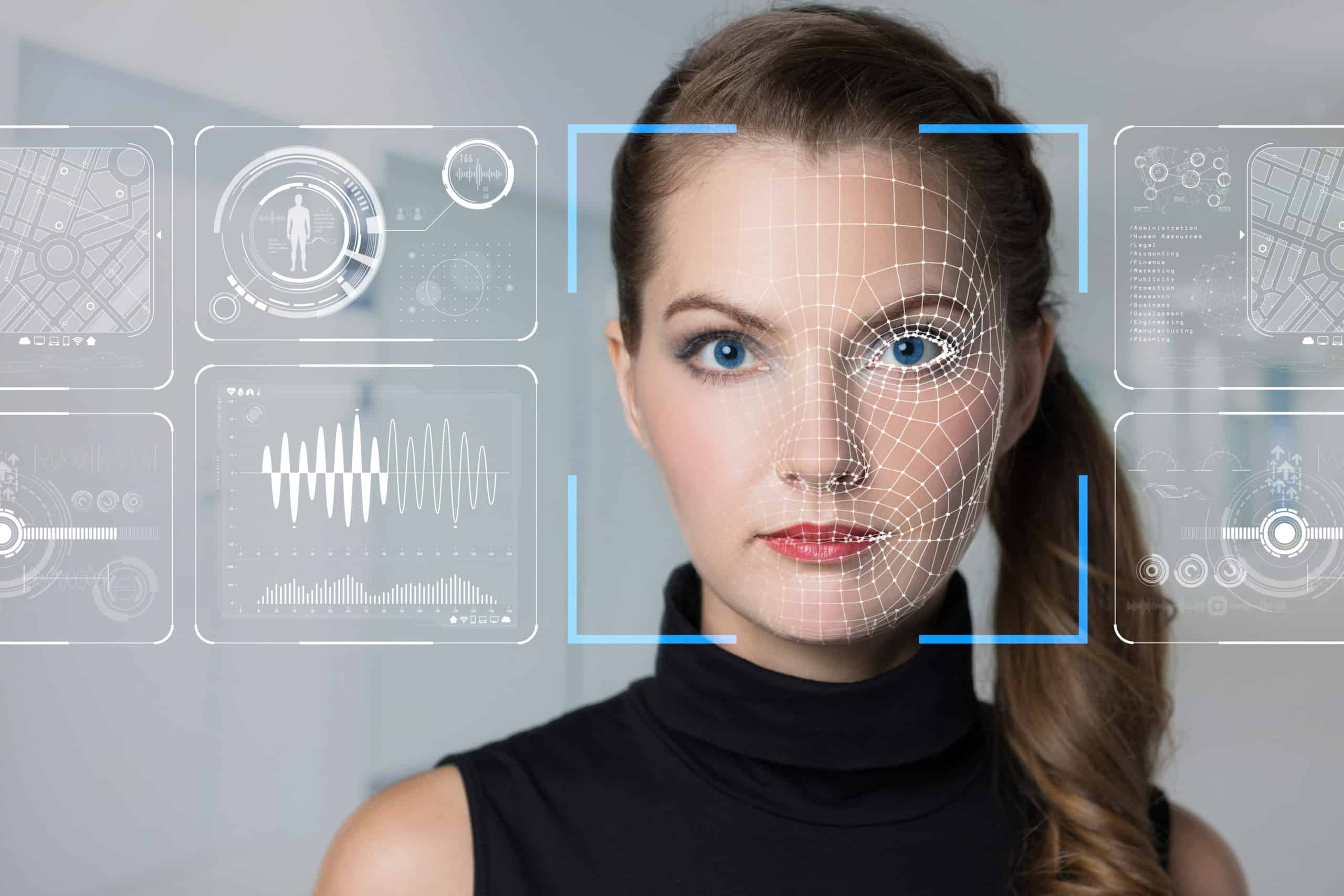

Biometric Security

Another developing trend in payment technology is biometric security. “Biometrics” is a fancy name for all the natural identifiers that are unique to you: fingerprints, voice recognition, retina and iris patterns, and DNA sequences. Smartphones can use one or more of these identifiers to secure a transaction so that no one can touch your accounts even if someone steals your phone, and so tech-savvy companies should keep biometrics in mind as they replace older equipment.

It can sometimes feel like currency and payment systems have only started to change the way they work in recent years, but all that’s really changed is how fast new methods catch on. Currency has been evolving ever since someone first decided to trade a cow for a few sheep, and if you want to appeal to the largest number of customers possible, your business has to be able to accept all the new payment methods.