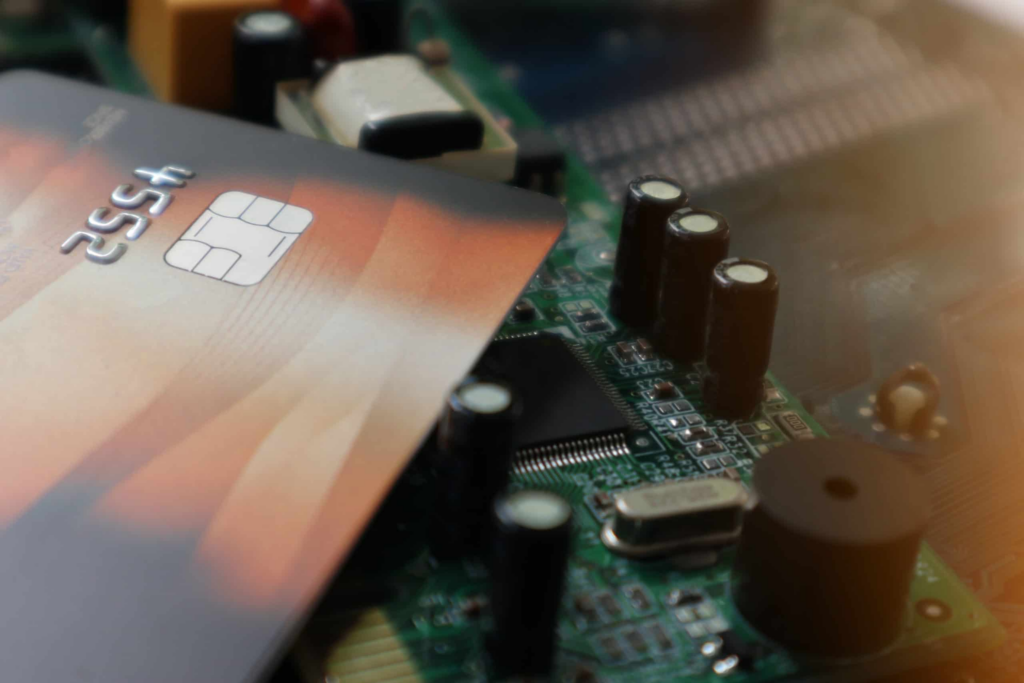

We still live in a world where cash, checks and money orders can be used to make payments and purchases, but nowadays merchants increasingly rely on electronic forms of payment as well. This can be a fast, convenient and secure method of payment, but there are a few things you should know about electronic payments so you can better use them to their full potential.

There Are Different Methods

In the same way that cash, money orders, bank transfers are different ways of changing cash from one form to another to move it to other locations for different uses, there is more than one system for electronic payment. You should look into the various options that you have available to you, since choices like automatic, recurring payments and invoicing methods can vary depending on what your needs are.

ACH vs Credit Card Processing

Automated Clearing House and Credit Card Processing have different pros and cons. Depending on the type of business you conduct, one may definitely be a better fit for you than the other. For example, the ACH system is generally cheaper to use, but that’s because it defers all the payments and transactions you make until the end of the business day, and does it all in one large, efficientbatch. Credit card processing on the other hand, will perform a transaction instantly, but you will need to pay for every individual transaction that occurs. Ultimately, the needs of your business will dictate with method is the right one for you.

Funding Time

The amount of time it takes for money from a payment to finally reach your bank account is known as funding time, and this varies with the different electronic payment methods. If scheduling for money is an important consideration for you, you should look into the different amounts of funding time specific to the different methods. ACH and credit card processing differ in these time tables, as do the different service providers and other factors.

Authorization

When using electronic payments, it is always important, especially for record keeping purposes, to ensure that proper authorization is obtained and documented. When reviewing specific payments, or providing information for audit/review purposes, authorization will be an important piece of key information. Always make an effort to ensure this information is present.