We believe in being transparent with business owners and giving the most detailed information to guide you on payment processing. So, this article provides the clearest breakdown of (point-of-sale) POS system costs you will find. It gets right to the point.

By the end of this article, you will have all the details you need related to POS system pricing, expenses, investment, and the average cost of a POS system. But that’s not all.

It helps to have real-world examples of businesses like yours or similar so you can see exact costs and precise reasons for those costs, right? That’s why we have included four different business types so you get a full picture of POS system costs.

Get ready to save money on your payment processing by preparing for the following costs and potential costs. Right after that, we have listed ways to reduce some of these expenses.

Understanding A POS System Investment

Remember, your business may not need all the components below, but it’s good to be aware of them.

Initial Hardware Costs:

- Cash drawer

- Receipt printer

- Barcode scanner

- Card reader

- Tablet or touchscreen monitor

- Kitchen printer (restaurants)

- Back-up equipment for the above (optional)

Software Costs:

- One-time license fee vs. monthly subscription

- Cloud-based vs. on-site solutions

- Per terminal or per user pricing models

Installation and Setup Fees:

- Professional installation

- Data migration from old systems

- Staff training costs

Ongoing Costs:

- Software updates and maintenance

- Technical support

- Cloud storage fees (for cloud-based systems)

Transaction Fees:

- Payment processing fees (often a percentage of each sale plus a fixed fee)

Additional Feature Costs:

- Inventory management add-on tools

- Customer relationship management (CRM) apps

- Advanced reporting and analytics tools

Scalability Considerations:

- Costs for adding new terminals or locations

- Pricing tiers based on business size or transaction volume

Hidden Costs to Consider:

- Hardware replacement or upgrades

- Additional staff training on new features

- Staff turnover means more training time

- Potential downtime during updates or migrations

- Connectivity issues leading to lost sales

That is a long list. Still, knowing what expenses might pop up helps you budget for them. Even better for your budget? Tactics for slashing some of the costs. Let’s look at ways to reduce POS system costs.

Cutting And Overcoming POS System Expenses

Cost-Saving Opportunities:

- Bundled hardware and software deals

- Long-term contracts with discounted rates

- Free trials to test before signing a contract

- Negotiate with providers’ sales rep (asking for discounts/freebies can’t hurt!)

Comparison Shopping:

- Get quotes from multiple payment processors

- Consider both upfront and long-term costs

- Evaluate features against your specific business needs

- Ask for example merchant invoices

- Talk with other business owners about hidden fees they encounter

- Ask providers if they offer a Guarantee of the lowest processing rates

Financing Options:

- Leasing vs. purchasing equipment

- Payment plans for higher upfront costs

- Small business loans or lines of credit

ROI Factors:

- Improved efficiency and reduced labor costs

- Better inventory management leading to less waste, fewer lost sales

- Marketing efforts improved by precise sales insights

- Tax-saving opportunities via advanced financial reports

- Enhanced customer experience, potentially increasing sales

Thankfully, that list of cost-saving opportunities is also lengthy. Meaning that you have ample chances to save money on your POS system. Just keep in mind that a high-quality POS is an investment that should help scale your business. When business growth happens monthly, then year after year, the investment pays off in enormous fashion.

In a moment, we have more POS expenses to make you aware. First, let’s take a peek at…

The Average Cost Of POS Systems

A simple separation of average costs are broken down into three categories. Software, hardware, and payment processing fees.

Average POS Software Costs: Monthly subscription costs have a wide range, being as low as $0 (free) on up to $200. Exact costs for your business depend on the provider, your sales volume, and POS software add-ons needed. *Some POS systems still use one-time fees versus monthly subscriptions.

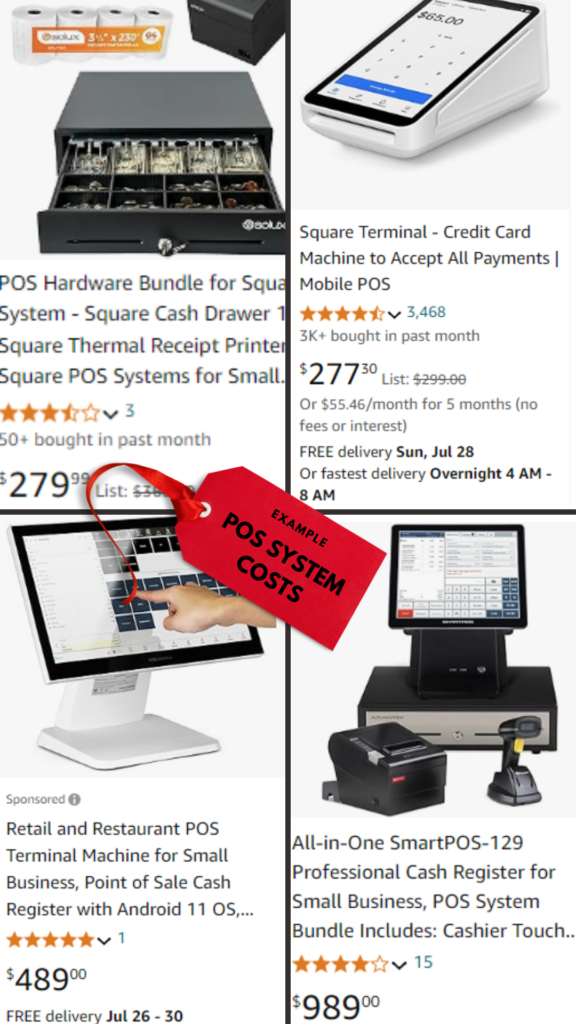

Average POS Hardware Costs:

- Basic Card Reader: $0 to $300

- Cash Registers: $39 to over $1,5000

- POS Terminals: $49 to $1,799 (high-end models cost up to $6,500)

- Self-Service Kiosks: $700 to $4,000

- Cash Drawers: $39 to $1,000

- Barcode Scanners: $20 to $600

- Receipt Printers: $26 to over $600

Remember, these are averages. Below are actual example prices from Amazon.

Average Payment Processing Fees: Range from 1.5% to 3.5% per credit card transaction. These averages are the most confusing for merchants when their payment processing contract uses unclear language. So read your agreement carefully before signing.

Additional Costs:

- Installation Fees: $0 to $700, depending on the complexity of the system.

- Add-Ons and Integrations: Extra features like customer loyalty programs, online ordering, appointment booking, etc. It’s impossible to calculate the average cost for extra POS features since there are thousands of add-ons available and more being developed each week!

How about POS system cost averages for specific industries?

Restaurant Industry

Operating a restaurant has many moving parts with staff, endless supplies, long hours, table management, and food delivery services. That means it’s crucial for restaurant business owners to have more advanced POS platforms, which can cost $80-$90 per month. With vertical systems (designed for specific business types), the hardware can cost as much as $800 (using Toast as an example).

Retail Industry

Here is another business type that is often complex, depending on the structure. An online-only t-shirt shop will have simpler needs than a brick-and-mortar clothing store with an e-commerce shop. So the range of POS system hardware costs are wide ($29 to $399), with similar averages for retail POS software subscriptions ($29 to $299).

General Small Businesses

Simpler business structures mean more basic POS needs, so many small businesses can find POS software for as low as $15 per month and purchase hardware on the low end for $60. And there are payment processors that offer free software to some small businesses in hopes of the business expanding and eventually needing a paid POS system (providers generate revenue via transaction fees even on free software or hardware).

High-Volume or Multi-Location Businesses

Average annual POS costs for a large business with multiple locations can range from $10,000 to $50,000+ per year. More equipment and more installs add up! Installation fees can cost from $250 to over $1,000. Enterprise-level POS software averages from $200 to $500+ per month per location.

Those POS system expenses don’t include the costs that come with each payment transaction, which has a small fee.

Now for those other POS costs that businesses that grow may want to invest in.

Additional POS System Costs For Growing Businesses

While we want to list all possible expenses, you may not have to worry about many of the following POS platform costs. We simply want you to be aware of all the potential costs.

Integration Fees:

- Costs for connecting POS with existing systems (e.g., accounting software, CRM)

- Custom API development for specific integrations

Customization Costs:

- Tailoring the POS system to specific business needs

- Creating custom reports or workflows

- Niche loyalty program

- Custom referral program

- Sync with email automation

Security and Compliance:

- PCI DSS compliance costs

- Security audits and updates

- Data breach insurance

Downtime Costs:

- Emergency IT support

Staff Training Costs:

- Potential errors during learning periods

- Fraud that occurs due to lack of training

Upgrade Costs:

- Moving to newer versions of software

- Hardware upgrades to support new features

- Adding durable mobile terminals for outdoor use

Opportunity Costs:

- Time spent managing and troubleshooting the system

- Potential lost sales due to system limitations

- Basic POS that limits marketing / advertising success

Luckily, there are plenty of ways to battle those costs too.

13 Ways to Overcome POS System Costs:

- Ask providers for bundle discounts, better rates for long-term commitments, and price matching.

- Use cloud-based solutions to reduce hardware and maintenance costs while benefiting from automatic software updates.

- Begin with basic features and add more as your business scales.

- Explore open-source POS systems to reduce software costs.

- Invest in comprehensive training for select staff members who can then train others.

- Rent or lease equipment to avoid upfront costs.

- Test POS systems before committing.

- Joining industry associations often gives you access to group purchasing power.

- Plan system check-ups to prevent costly downtime and security disasters.

- Create training materials and videos (systems save time, money, and hassles).

- Purchase certified refurbished equipment with warranties.

- Use POS data to optimize inventory, staffing, customer experience, marketing, referrals, and repeat business.

- Combine cloud and on-premise solutions for cost-effective scalability.

Conclusion

Feel free to bookmark this page so you can review it as your business grows.

Some POS system costs aren’t affecting you today but could in the near future. Now you have a resource to prepare for expenses if and when they become an issue.

The three biggest takeaways from this post are:

- Payment processing fees are as important as payment hardware and software costs.

- Endless POS feature options can overwhelm you, so ask providers for guidance based on the features similar businesses to yours use.

- POS systems should boost revenue to overcome platform costs.

Thanks for reading. Please note the FAQ below.

POS system investment FAQ

What are five unexpected POS-related costs for ecommerce stores?

Reporting tools, transaction and payment gateway fees, cybersecurity measures, return fraud, and shipping costs inflation.

What expenses are hurting home services businesses but can be lowered by POS systems?

Rising costs of online advertising could be minimized by strategic ad campaigns based on customer behavior data and transaction histories using POS data and reports.

Which costs can salons reduce by using POS features?

Less product waste with better inventory management, reduced time on tax preparation using POS analytics, and reduced credit card fees using POS chargeback alerts to stop chargebacks before they happen.