It may seem strange that National Processing would highlight ways your business can save money by accepting cash.

After all, when you accept a cash payment, you don’t pay a credit card processing fee and we don’t receive that fee. However, we feel it’s important to help business owners know their options.

Besides, consumers aren’t going to stop paying with digital methods altogether. So our business isn’t harmed by showing businesses ways to reduce payment fees.

We are happy to help and that’s why we are looking at (point-of-sale) POS systems vs. cash registers. You will discover several pros and cons of digital payments vs. cash that you may have never considered. So let’s take a look.

See National Processing’s Cash Discount Program

Basic Breakdown: POS System VS. Cash Register

We are anxious to show you ten insightful stats related to this POS system comparison with cash registers, but first up are the main comparison points.

Pros of Cash Registers:

- Low cost

- Simpler to use

- Unreliable internet connectivity is not a concern

- No worry of cybersecurity threats

Cons of Cash Registers:

- Limited functionality

- Manual inventory tracking

- Difficult to generate detailed sales reports

- No integration with other business systems

Pros of POS Systems:

- Streamlined inventory management

- Detailed sales analytics

- Integration with accounting, e-commerce, and customer relationship management (CRM) systems

- Advanced features like loyalty programs and gift cards

Cons of POS Systems:

- Higher upfront costs

- Reliance on internet connectivity

- Possible technical issues and downtime

- Software updates and maintenance needs

Basically, POS systems vs. cash registers comes down to which tools and features you need to make your business run efficiently.

Traditional cash registers may be ideal for simple businesses, especially when the owner does all the work and has no plans to hire employees. More on this aspect of cash registers in a moment.

The flip side is POS systems. These give you limitless tools, features, and add-ons that make your business run smoother than you ever imagined. Increased efficiency means the most for businesses that are complex or growing rapidly.

Now, we will show the comparison stats we mentioned.

POS System VS. Cash Register, Just The Facts

The following stats give you a well-rounded view of accepting payments in various forms using a cash register vs. POS platform.

- Forbes expects the global POS software market to reach $30.9 billion by 2026

- Cash remains popular, as 67% of Americans use it for in-store purchases

- POS systems usually come with 24/7 customer support

- About 7.1 million U.S. households don’t have a bank account (unbanked), so cash is essential for their transactions

- It’s difficult to offer self-checkout with a cash register

- Some municipalities legally require retailers to accept cash to protect unbanked customers

- Mobile phone POS apps are making standalone cash registers unnecessary in some businesses

- Cash registers can be part of a POS system (add a cash drawer or choose POS with a cash drawer)

- About 42% of retail sales come via POS terminals

- Cash provides purchase privacy amid rising concerns over digital tracking of consumers

Two of the biggest keys from above are:

#1 Make shopping accessible for people without bank accounts

#2 It’s smart business to add a cash drawer to your POS system

And this next merchant story shows the major upsides of implementing a cash discount program.

Cash Register Drawbacks And Benefits

We worked with a small convenience store a few years ago that saved an impressive amount on processing fees. How? The owner promoted his “cash preferred” philosophy. Correction — he promoted it heavily!

It was posted on the front door, the drive-thru window, and at the counter. The signage was big and bold, and it read simply…

“Cash Preferred”

This business owner was well-liked by his loyal customers, so they were happy to use cash when they could. Plus, the signage made other customers wonder why he preferred cash. So they would ask him, and he told them it saved him money on credit card fees.

You’d be surprised how many customers never think about payment processing fees paid by merchants. Why would they? Customers are not running a business so transaction fees are not even on their radar.

The store owner eventually shifted the processing fees to the customers (100% legal in his state as long as it is disclosed to customers). He was then able to inform customers that using cash saved them money. That was even more important to shoppers than saving the merchant money!

See how simple steps like promoting a “cash discount” can cut out thousands of dollars in payment processing? Those savings become tens of thousands of dollars as the years add up.

Any drawbacks of cash registers in this case?

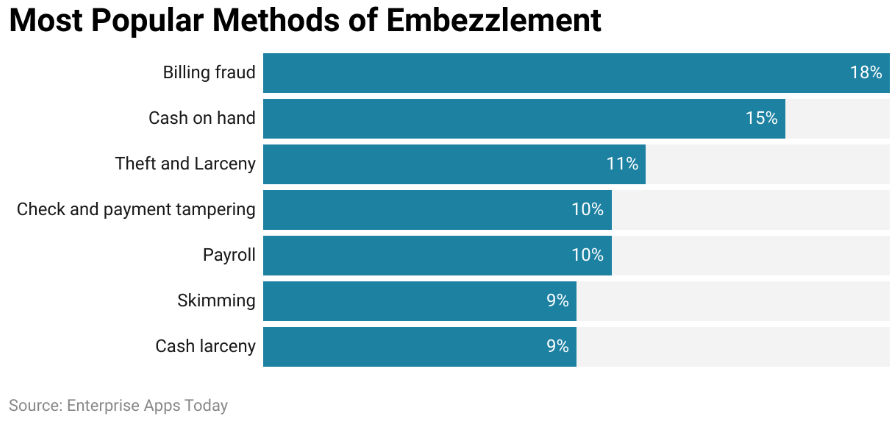

Though this convenience store owner saved money, there are drawbacks to accepting large amounts of cash. For one, he constantly worried about employee theft. It is tough to track cash transactions, no matter how meticulous your accounting.

In fact, it wasn’t until one employee was let go for a different reason that the owner discovered sales “magically increased” the month after the termination.

Next is the worry of being robbed. The previous owner of his store had been robbed at gunpoint twice. That scary possibility is enough for many business owners to avoid taking in too much cash and focus on digital payments. Who can blame them?

One more note on this business that relates to potentially selling your business someday.

POS System VS. Cash Register Reporting

Selling a business can take years. But when you have comprehensive sales records, it can speed up the process. How? Potential buyers can see concrete proof of your sales volume and that the business is thriving.

These records benefited this store owner because, over the years, he was able to collect and organize detailed POS system reports on his sales, trends, customer habits, and profits. When he put the store up for sale, these easy-to-understand POS reports told potential buyers all they needed to know in about ten minutes.

Just ten minutes to analyze the success of a twelve-year period!

Let’s take a step back to look at POS systems vs. cash registers and employee theft.

More Locations And Employees Boost POS System Benefits

It’s hard to find a cash register drawback for solopreneurs or owners who run a business without any employees. These entrepreneurs don’t have to worry about cash being stolen by staff since the owner’s hands are the only hands in the “cookie jar” — aka the cash register.

It’s easy to keep records when you’re the only one handling a business’s finances.

Having your hands directly in the daily operations of a business is the best way to understand the customers, operations, and financial nuances. In fact, con artists don’t stand a chance of slipping counterfeit cash past an experienced convenience store owner because the owner has a literal feel for real money. Their fingertips are better than a counterfeit-detecting device!

However, counterfeit cash is a cash register drawback when you have employees.

They are more likely to be fooled by fake cash due to lack of experience. This is made worse if you have high turnover or younger employees who rarely use cash and have no “feel” for real bills versus fake ones.

Not to mention how hard juggling multi-location sales data, inventory, employee management, etc. would be without a modern POS platform.

The good news is you don’t have to settle.

Get More POS System Benefits With A Cash Register

The best POS system is one that enables you to efficiently accept cash. Having a cash drawer added to your POS allows you to serve people without access to a bank or digital payment methods. Plus, a cash drawer gives you a chance to offer cash discounts that save you money (or your customers money) by cutting out some processing fees.

Even better? Modern POS platforms help manage and organize cash transactions in multiple ways, such as:

- Automated cash reconciliation at the end of the day

- Programmable employee access codes and theft deterrents add security

- Detailed cash transaction reports help identify potential theft or mistakes

- Real-time counts to advise when to make a bank or safe deposit

The key is to get the best of both worlds with a POS system that includes a cash drawer.

Thanks for reading. If you have more questions, we’ve got you covered below.

POS SYSTEM VS. CASH REGISTER FAQ

Is it easier to train staff on a cash register or a POS system?

Cash registers are easier to learn initially. But in-depth training for POS pays off in efficiency and capabilities in the long run.

Can a POS system work without an internet connection?

Some systems offer an offline mode to handle basic sales processing when the internet is down (data syncs after internet connection is restored). Traditional cash registers don't require an internet connection.

Ways to deter employee theft with cash registers?

Use clearly defined cash handling procedures. Do regular cash counts and reconciliations. Install security cameras in cash handling areas. Lastly, require two employees for cash counts or transfers.