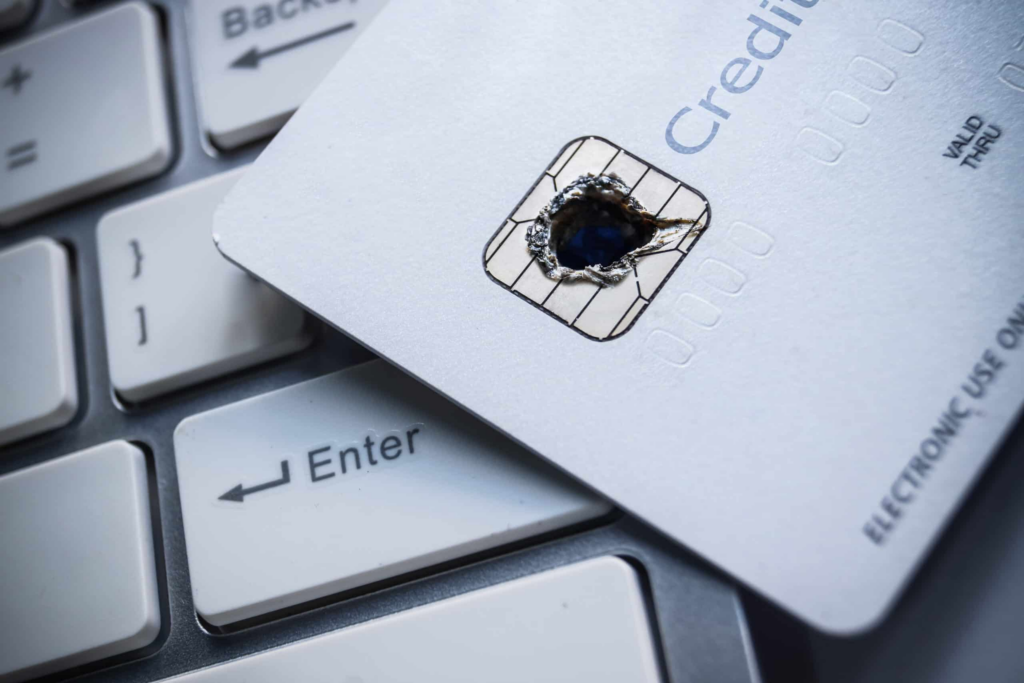

The credit card is one of the most versatile ways for people to buy things in the modern world. With a credit card, even if you don’t have the money on hand, credit card processing allows for people to make convenient or necessary purchases. This can be done either at a store, it can be done online, and it can even be done in other countries, making the credit card one of the most preferred payment systems in the world.

But there’s one danger with credit cards that is a magnification of the danger of cash. When cash is stolen, it can obviously be used to make purchases the original owner of the cash didn’t intend. The same is true with credit cards, where, if the card is stolen, someone other than the legitimate owner can make purchases right up to the credit limit for that card. What happens to businesses if something like this occurs?

The Customer Is Protected

First and foremost, credit card fraud is a form of identity theft. It simply means that either the physical credit card itself, or the number on the credit card has been secured and is now being used, but not by the rightful, legal owner. Of course, the issue with credit card fraud, in this case, is that you, executing the merchant processing, are not aware that this credit card transaction taking place is a case of identity theft.

So while the transaction itself may occur smoothly, it is not a legal transaction, even after all the approvals go through and you receive payment from the credit card company. However, even though you have already been paid, the law in these matters tends to land on the side of the victim. In other words, victims of identity theft for the purposes of credit card fraud cannot be held liable for the purchases made on their cards, without their permission.

It’s Not Your Fault Either

Here’s where things get complicated. Even if you may have been responsible for the credit card processing, it’s unreasonable to place the blame on you, especially if you simply follow standard procedure and allow a transaction to go through that gets approved.

In most cases, when an investigation is being conducted, you may be a part of that investigation, simply because your business was where some of the illegal purchases took place. But ultimately it is the bank, usually in affiliation with the credit card company, that is deemed responsible for approving the transactions. So while your business may not be held liable for the illegal transaction, that doesn’t mean you’re completely out of the forest either.

Depending on circumstances, you may have to face the possibility that you won’t be compensated for the services or products that have already been rendered. This is why it’s very important for businesses to make sure their anti-fraud mechanisms and techniques are up to date. If you see anything suspicious about a particular purchase that is being made by credit card, take extra time to get additional confirmation.